best candlestick patterns for forex, stock, cryptocurrency trades. Bullish and bearish engulfing

Candlestick: Bullish vs Bearish #stockmarket #downtrend #trading #crypto#priceaction #uptrend #Higherhigh #higherlow

Bullish And Bearish Candlestick Charts Candle Stick Trading Pattern

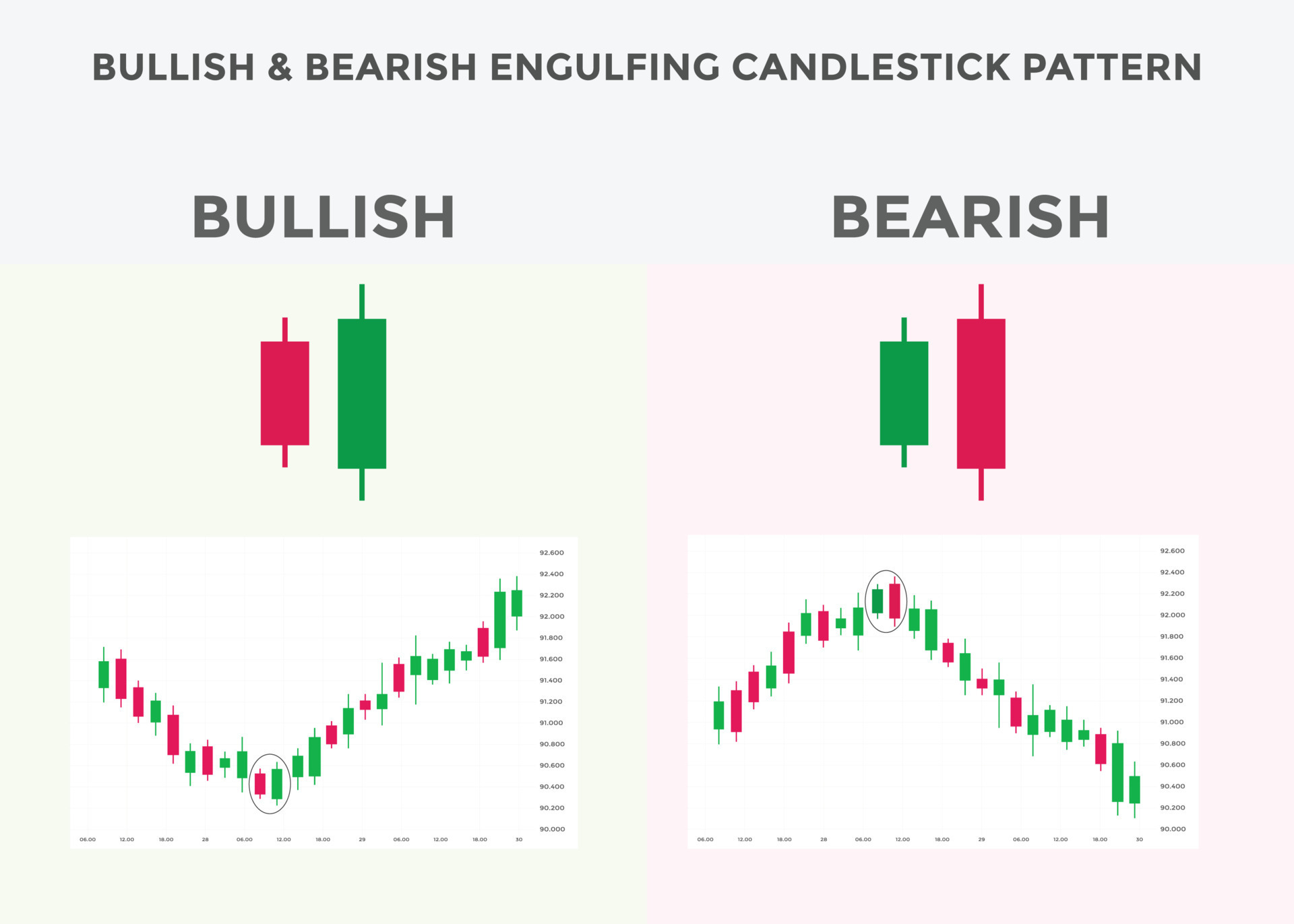

What is a Bearish Engulfing Pattern? A bearish engulfing pattern is a technical chart pattern that signals lower prices to come. The pattern consists of an up (white or green) candlestick.

145 CANDLESTICK PATTERNS PAGE 9 (17) Morning Star ( Bullish ) ; (18) Evening star ( Bearish)

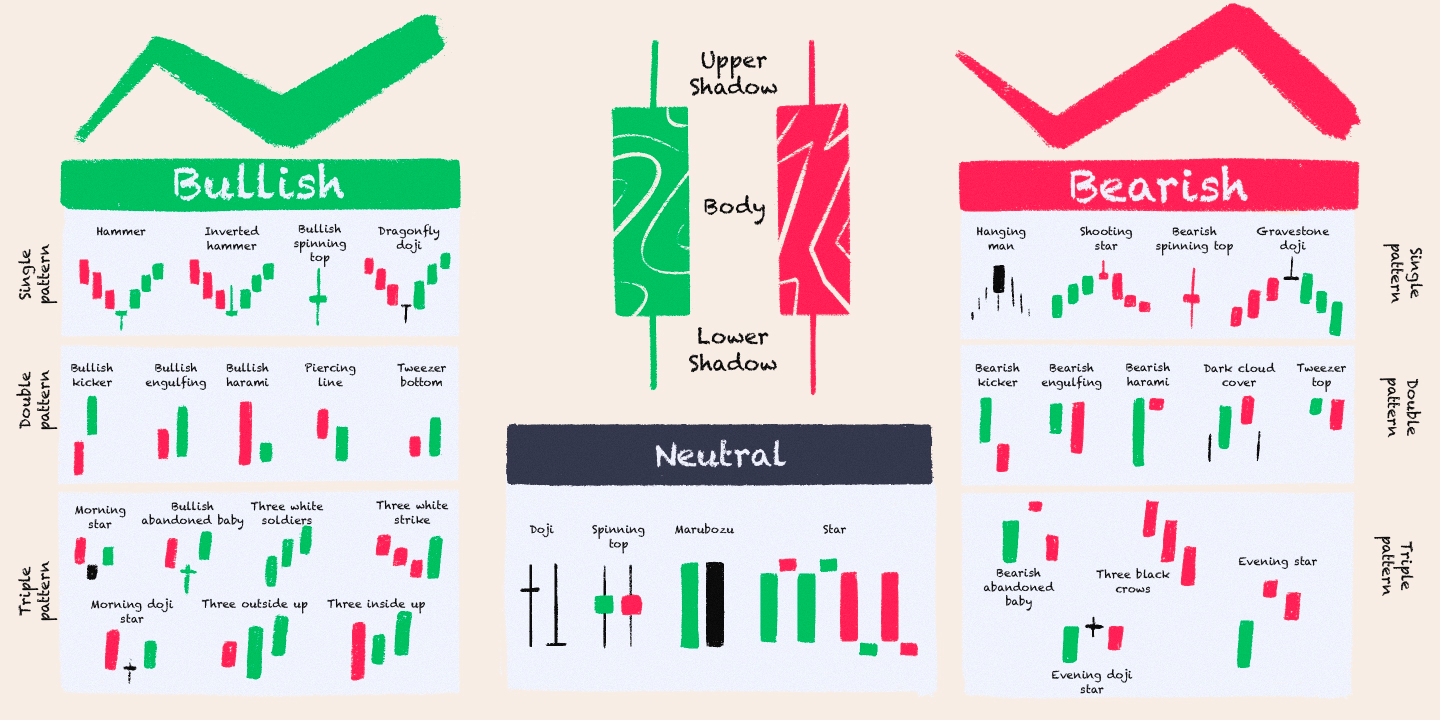

Bullish candlestick patterns can be used by traders and investors to identify potential buying opportunities. Some common bullish candlestick patterns include the following signals. 1. The.

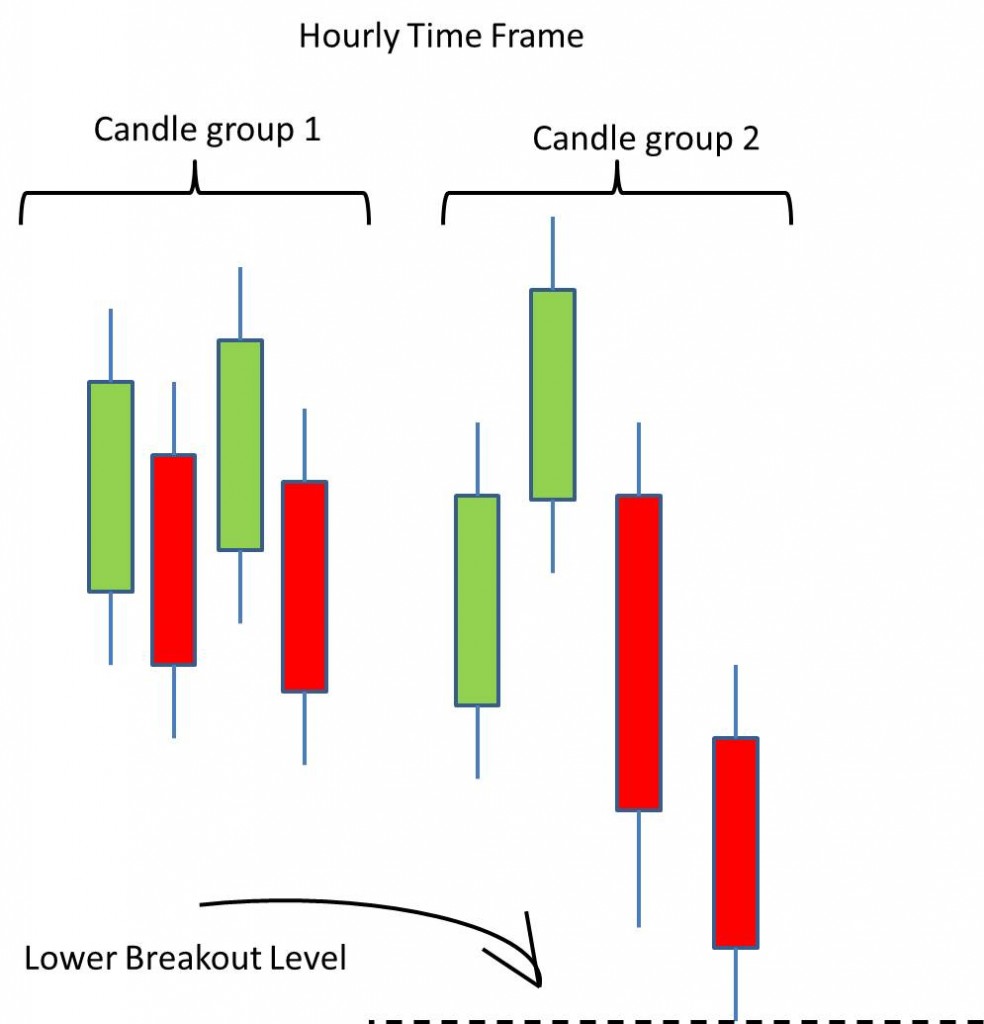

How to read candlestick patterns What every investor needs to know

Is a doji candle bullish or bearish? How about a spinning top? Our goal in this tutorial is to uncover the fundamentals of indecision candlestick patterns, their significance, and a few strategies for how to trade them. By the end, you should be able to spot bullish and bearish dojis, spinning tops, and haramis!

Bullish & Bearish Engulfing Bars (Part I) FXMasterCourse

Bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Many of these are reversal patterns.

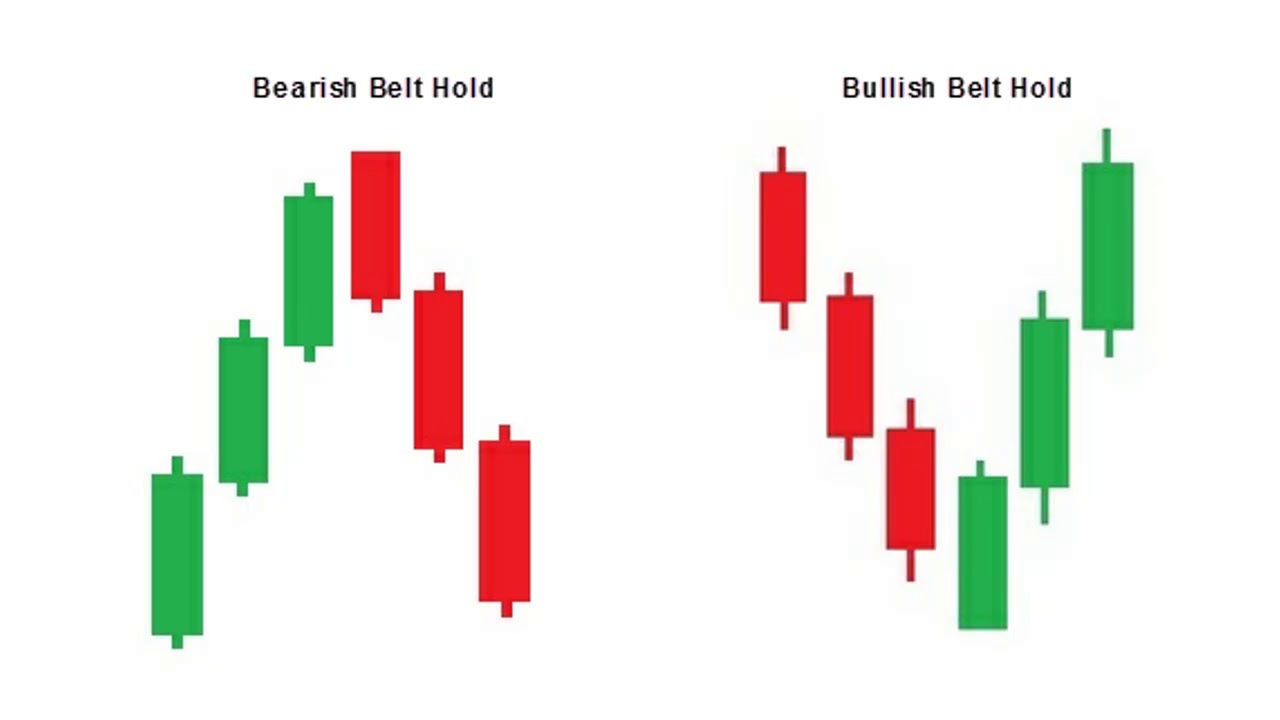

Bullish and bearish belt hold candlestick patterns explained on E

Bullish Harami Candlestick is a price chart pattern formation that signals a bullish trend reversal. A bullish Harami candlestick comprises two candlesticks including a long bearish candlestick and a short bullish candlestick. The name Harami traces its origin to the Japanese language. Harami in Japanese means :" Pregnant:" It consists of.

Candlestick Bullish And Bearish Candle Stick Trading Pattern

By Bullish Bears Updated November 7, 2023 7 min read SHARE THIS ARTICLE Bearish candlesticks come in many different forms on candlestick charts. There are also bullish candlesticks. Bearish candles show that the price of a stock is going down. They are typically red or black on stock charts.

Bullish & Bearish Engulfing Bars (Part III) FXMasterCourse

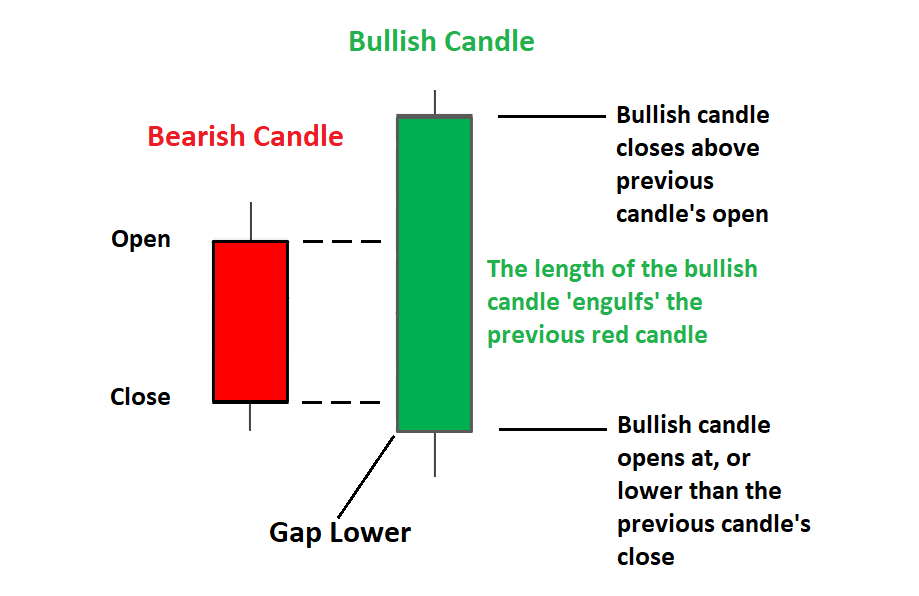

A bearish engulfing pattern occurs after a price moves higher and indicates lower prices to come. Here, the first candle, in the two-candle pattern, is an up candle. The second candle is.

:max_bytes(150000):strip_icc()/UsingBullishCandlestickPatternsToBuyStocks1-ac08e48665894dbfa263e247e53ba04e.png)

Using Bullish Candlestick Patterns To Buy Stocks

The Bearish Engulfing pattern involves a smaller bullish candle followed by a larger bearish candle that completely engulfs the preceding one. This pattern indicates a potential shift from a bullish to a bearish trend. The presence of a bearish engulfing pattern signals that sellers are gaining control, suggesting the likelihood of a developing.

Bullish and Bearish Reversal Candlestick Patterns in Trading

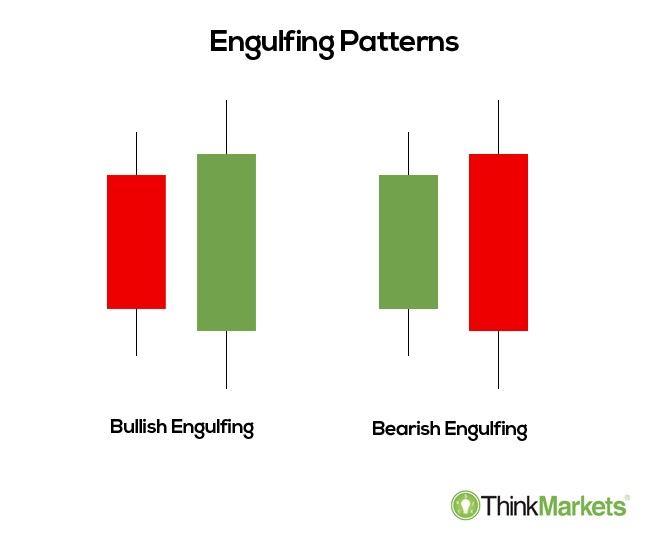

Bullish and bearish engulfing candlestick patterns are powerful reversal formations that generate a signal of a potential reversal. They are popular candlestick patterns because they are easy to spot and trade. Structures A bullish engulfing candlestick pattern occurs at the end of a downtrend.

What Is Bullish Engulfing Candle Pattern? Meaning And Strategy

Beginner Elementary Intermediate Experienced Below you can find the schemes and explanations of the most common reversal candlestick patterns. Bullish patterns Bullish reversal patterns appear at the end of a downtrend and signal the price reversal to the upside. Hammer A 1-candle pattern.

Bullish and Bearish Engulfing Candlesticks ThinkMarkets EN

Comprising three candles, the evening star pattern starts with a bullish candle, followed by a small-bodied or doji candle, and then a larger bearish candle. It signifies a potential reversal. Here is an image to get a clear idea about an evening star pattern.

Using 5 Bullish Candlestick Patterns To Buy Stocks

Most bullish reversal patterns require bullish confirmation. In other words, they must be followed by an upside price move which can come as a long hollow candlestick or a gap up and be.

Top 6 Most bullish Candlestick Pattern Trade with market Moves

In the world of finance, candlestick patterns are a powerful tool used by traders to gauge market sentiment and make informed decisions. They are an essential component of technical analysis, providing insights into the price movements of stocks, cryptocurrencies, or other financial instruments. Bullish and bearish candles, two primary types of candlesticks, play a significant. Continued

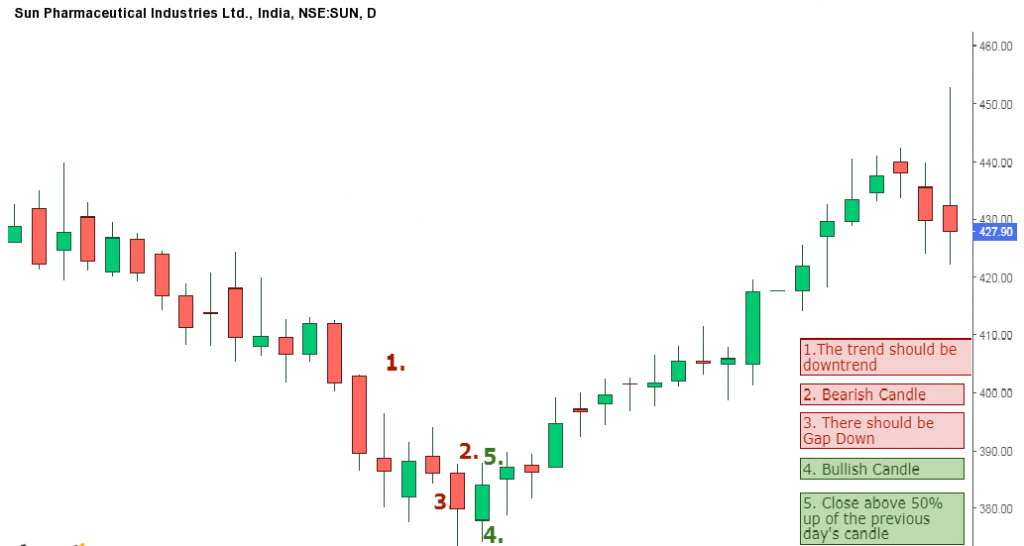

Bearish Candlestick Patterns Blogs By CA Rachana Ranade

1. The Hammer If you are familiar with the bearish "Hanging Man", you'll notice that the Hammer looks very similar. But as the saying goes, context is everything. Much like the Hanging Man, the Hammer is a bullish candlestick reversal candle. The context is a steady or oversold downtrend.

Is A Hammer Bullish Or Bearish Candle Stick Trading Pattern

This in-depth guide will help you get familiar with bullish and bearish candlestick patterns and learn how to use them in your daily trading activities. Introduction to Candlestick Patterns How to Read Candlestick Patterns? Bullish Candlestick Patterns Bearish Candlestick Patterns Reversal Candlestick Patterns Conclusion About Candlestick Patterns