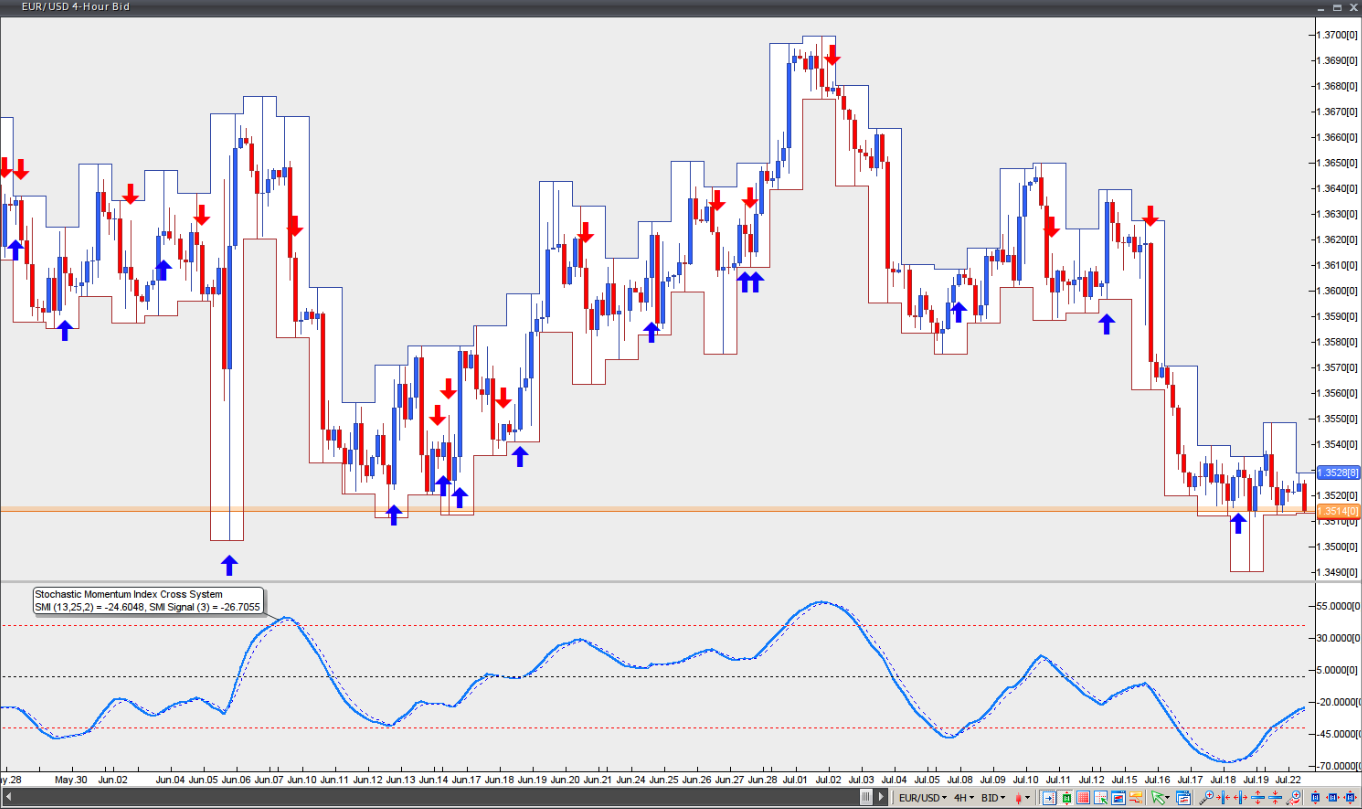

Stochastic Momentum Index Forex Trading Indicators

A stochastic oscillator is a momentum indicator comparing a particular closing price of a security to a range of its prices over a certain period of time. The sensitivity of the oscillator to.

Indicator hack Stochastic Momentum Index Traders Bulletin

The stochastic momentum index (SMI) is like the stochastic oscillator on steroids and was brought to the trading world by William Blau. Instead of reading the closing price of the asset as the standard stochastic indicator, the SMI will calculate the closing price in relation to the average of the high/low range.

Stochastic Momentum Index StockViz

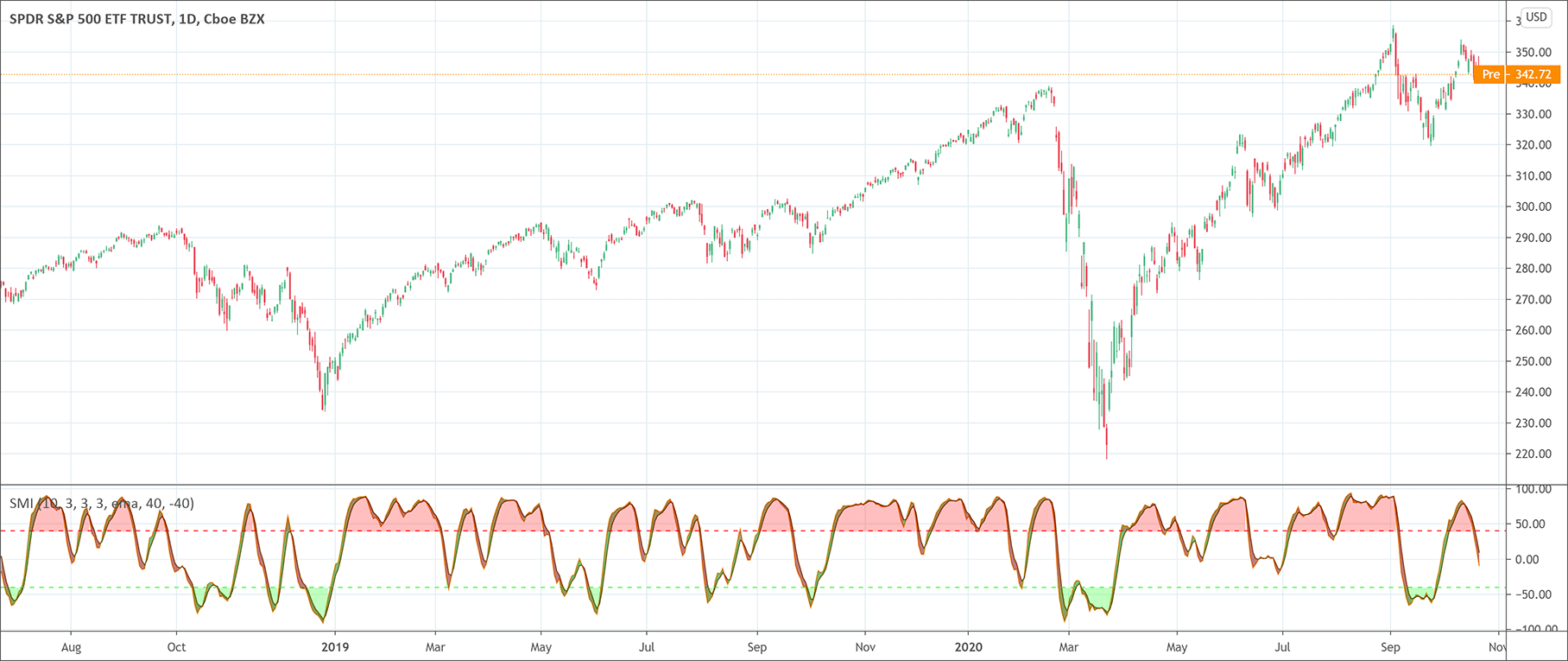

What is the Stochastic Momentum Index? The Stochastic Momentum Index (SMI) is an indicator of momentum for a security. The SMI is used in technical analysis as a refined alternative to a traditional stochastic oscillator.

boutique trading strategies Can you Use A Stochastic Momentum Index

The Stochastic Momentum Index (SMI) is similar to Stochastic Oscillator with the difference that it finds position of the Close price relative to the High-Low range's midpoint, not the range itself. This difference results in the oscillator being plotted on the -100 to +100 scale.

stochastic momentum index TradingAttitude

Description. Stochastics Momentum Index (SMI) was created by William Blau in 1993 and is based on the Stochastics Oscillator. SMI is considered as a smoothed version of Stochastics Oscillator. Stochastics Momentum represents the location of the close price in relation to the midpoint of the high/low range while the Stochastics Oscillator calculates the close price position in relation to the.

Stochastic Momentum Index (SMI) Analyzing Alpha

The Stochastic Momentum Index (SMI) is a technical indicator that measures the momentum of an asset's price. The SMI is a refinement of the stochastic oscillator developed by George Lane in the 1950s.

Stochastic / Stochastic Oscillator What Is It And How To Utilize It Ewm

The stochastic momentum index (SMI) is a technical analysis tool that analyzes price momentum. It's calculated using the closing price relative to the median range (high-low) of the security's price over a specified period. The indicator is represented on a chart as an oscillator, not to be confused with the stochastic oscillator, as seen.

Stochastic Momentum Index Indicator Formula, Strategy StockManiacs

The Stochastic Momentum Index can be utilized in technical analysis as an alternative to the traditional stochastic oscillator. SMI is a calculation of the distance from the current close price of an asset concerning the high and low-price range. This is visually reflected in the chart, usually with an exponential moving average (EMA).

SMI Aksjesnakk

Stochastic Momentum Index. everget Wizard Updated May 9, 2018. Stochastic Oscillator Centered Oscillators Momentum Indicator (MOM) SMI blau Stochastics. 2094. 10. Mar 27, 2018. Stochastic Momentum Index indicator script. This indicator was originally developed by William Blau (Stocks & Commodities V. 11:1 (11-18)). May 9, 2018.

Stochastic Momentum Index (SMI) General MQL5

What is the Stochastic Momentum Index Indicator? First of all, Stochastic Momentum Index Indicator is an advancement in the Stochastic Oscillator. Traders primarily use the stochastic Oscillator to calculate the distance between the Current Close and Recent High/Low Range for the n-period.

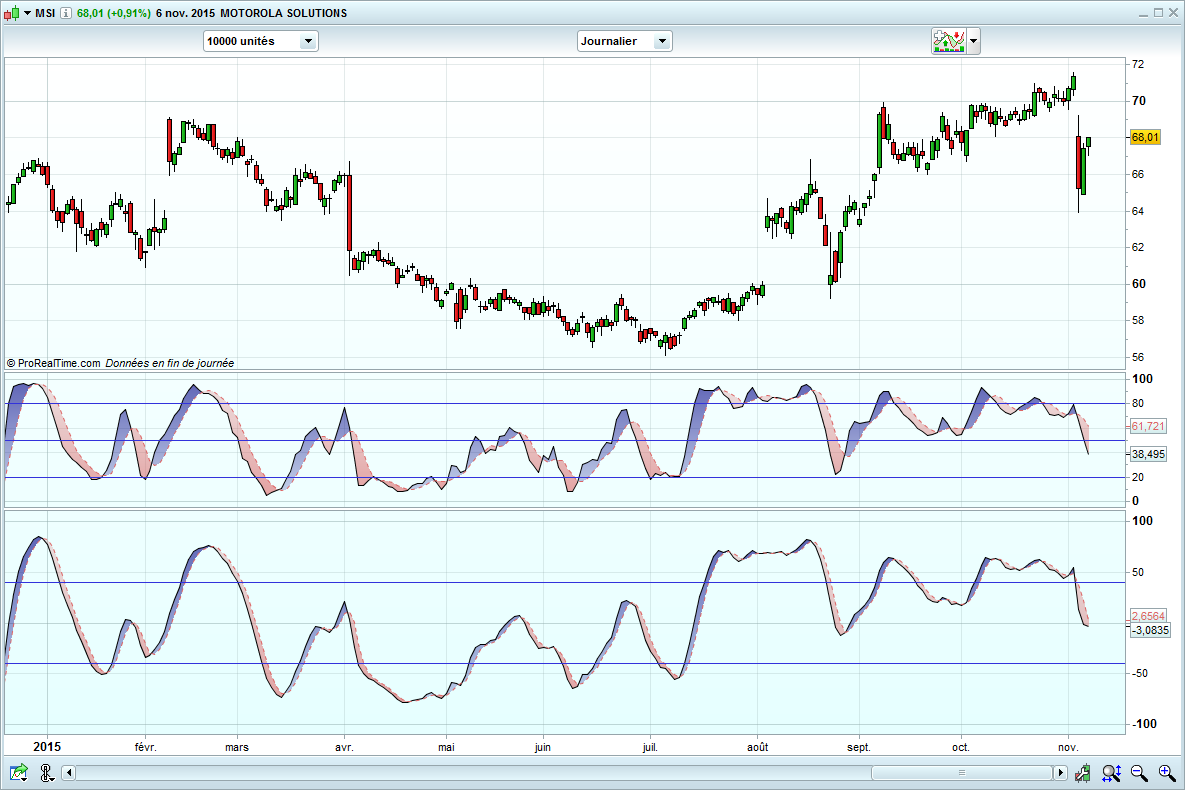

CUSTOM Stochastic Momentum Index Indicators ProRealTime

Stochastic Momentum Index (SMI) or Stoch MTM is used to find oversold and overbought zones. It also helps to figureout whether to enter short trade or long trade. Red Shade in the Top indicates that the stock is oversold and the Green shade in the bottom indicates overbought. Strategy:

Stochastic Momentum Index Indicator Formula, Strategy StockManiacs

The Stochastic Momentum Index (SMI) is an enhanced version of the regular stochastic oscillator, designed to be a more reliable indicator that minimizes false swings by measuring the distance between the current closing price and the median of the high/low price range.

Indicator hack Stochastic Momentum Index Traders Bulletin

The Stochastic Momentum Index (SMI) fits into the range of momentum indicators by providing a refined view of price momentum. It compares the closing price to the midpoint of the range, rather than to the high-low range used by many other oscillators.

Indicatore tecnico SMI [Guida] Stochastic Momentum Index

The Stochastic Momentum Index, or SMI, shows the closing momentum and its relation to the median high/low range for that period. Stochastic Oscillator The stochastic oscillator is a.

Stochastic Momentum Index Strategies for Smart Investors

The Stochastic Momentum Index (SMI) is similar to Stochastic Oscillator with the difference that it finds position of the Close price relative to the High-Low range's midpoint, not the range itself. This difference results in the oscillator being plotted on the -100 to +100 scale.

Stochastic Momentum Index Upgraded Indicator PatternsWizard

The Stochastic Momentum Index (Stoch) normalizes price as a percentage between 0 and 100. Normally two lines are plotted, the %K line and a moving average of the %K which is called %D. A slow stochastic can be created by initially smoothing the %K line with a moving average before it is displayed.