Form 1118 Instructions For Schedule J Sheet printable pdf download

When completing a Form 1118 for foreign branch category income, enter the code "FB" on line a at the top of page 1. Foreign branch category income does not include passive category income. Foreign branch category income is effective for tax years of U.S. persons beginning after December 31, 2017.

Instructions For Form 1118 2007 printable pdf download

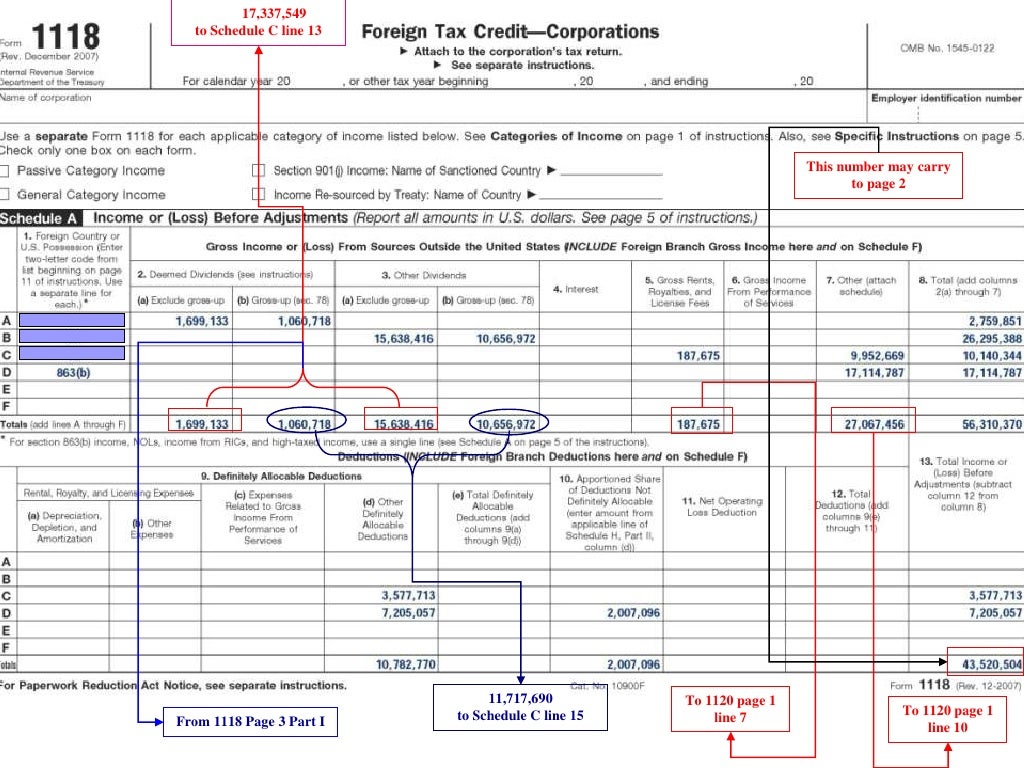

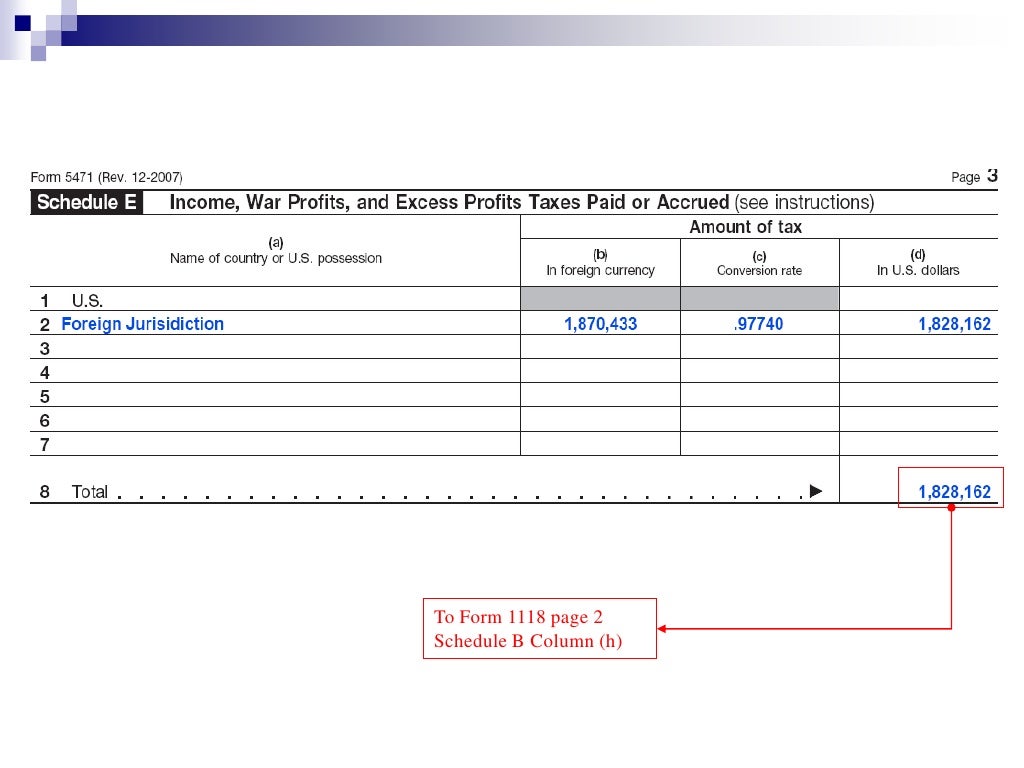

This article is designed to supplement the instructions for the Form 1118 promulgated by the IRS. Introduction to Schedule B Schedule B is utilized to report foreign taxes paid, accrued, or deemed paid for the taxable year. All transactions on Schedule B must be reported in U.S. dollars. If the corporation must convert from foreign currency.

Подвеска двигателя ВАЗ1118 "Калина"

General Instructions Purpose of Form Use Form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or U.S. possessions. See Taxes Eligible for a Credit, later. Who Must File Any corporation that elects the benefits of the foreign tax credit under section 901 must complete and attach Form 1118 to

Forms 1118 And 5471

To generate Form 1118 on a Corporate Return: From the Input Return tab, go to Credits ⮕ Foreign Tax Credit (1118). In the General Information subsection, select the Foreign country, US possession or special case code from the drop-down menu. Select the Category of income from the drop-down menu. Go to the Schedule B tab at the top of the.

Aresa AR1118 download instruction manual pdf

Since Form 1118 is not mandatory, no one is required to file it. However, failing to claim the corporate Foreign Tax Credit could leave you vulnerable to double taxation. That would mean paying more taxes than necessary—which is always worth avoiding! Form 1118 Instructions. Filling out Form 1118 can be complicated and time-consuming.

Instructions For Form 1118 Foreign Tax Credit Corporations 2002

Therefore, the Form 1118 continues to require reporting under pre-enactment provisions, as well as requiring new reporting for post-enactment provisions. General Instructions Purpose of Form Use Form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or U.S. possessions.

Intermediate Chassis Instructions Instructions are right h… Flickr

Follow these steps: Go to Screen 30, Foreign Tax Credit (1118). In the General Information subsection, select the Foreign country, US possession or special case code from the dropdown. Select the Category of income from the dropdown. Scroll to Schedule B - Foreign Taxes Paid, Accrued, and Deemed Paid and enter applicable amounts.

Instructions For Form 1118 Foreign Tax Credit Corporations 2011

While the IRS is not necessarily requesting new information, the format is new. In 2021, taxpayers were required to attach a schedule outlining all other deductions. In 2022, the IRS is standardizing this request. Form 1118 (Schedule L) (Final Rev. Dec. 2022), Foreign Tax Redeterminations, has been updated for a handful of items.

Top 26 Form 1118 Templates free to download in PDF format

for instructions and the latest information. OMB No. 1545-0123 Attachment . For calendar year 20 , or other tax year beginning , 20 , and ending . Sequence No. 118. Name of corporation. Employer identification number. Use a separate Form 1118 for each applicable category of income (see instructions). a

Instructions For Schedule K (Form 1118) printable pdf download

Instructions for Form 1118 for additional information regarding separate category and country codes. Line d. Check the box on line d if an election is made under Regulations section 1.905-5(e) to account for foreign tax redeterminations with respect to pre-2018 tax years in the foreign

Forms 1118 And 5471

While the Form 1118 instructions have not yet been issued, the forms are once again growing in size due to the IRS's increased desire for visibility. New Form 7204 (Draft Rev. Dec. 2022), Consent To Extend the Time To Assess Tax Related to Contested Foreign Income Taxes.

Search LEGO® instructions

instructions for additional information. Schedule G includes a new Part II, which requires the corporation to indicate whether it paid or accrued any taxes that were disqualified under section 901(m) or suspended under section 909. General Instructions Purpose of Form Use Form 1118 to compute a corporation's foreign tax credit for certain

an instruction manual for the front end of a vehicle, including parts

Schedule L (Form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each applicable separate category, the years to which they relate, and other information that satisfies the taxpayer's obligation to notify the IRS of foreign tax redeterminations related to prior years.

Form 1118 Claiming the Foreign Tax Credit for Corporations

Page 2 of 11 Instructions for Form 1118 10:33 - 5-MAR-2002 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. A noncontrolled section 902 1118, check the box for section 901(j) applicable), multiplied by the amount of

Instructions

1118, Schedule B, Part III instructions). If Schedule L reports a foreign tax redetermination in a category of income for which a Form 1118 is not filed in the current tax year, file such Schedule L with the category of income that completes Schedule B, Part III. In addition, complete and file a separate Schedule L for each

Aresa AR1118 download instruction manual pdf

for instructions and the latest information. For calendar year 20 , or other tax year beginning , 20 , and ending , 20 . OMB No. 1545-0123. Attachment Sequence No. 118. Name of corporation. Employer identification number. Use a separate Form 1118 for each applicable category of income (see instructions). a